Categories

Resource Links

GIR's Investing in the New Europe

GIR's Investing in the New EuropeBloomberg Press, 2001, "Sound, practical advice."

Wall Street Journal Europe

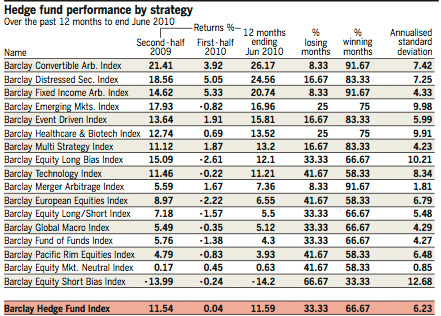

HEDGE FUND STRATEGIES THAT ARE WORKING IN DOWN AND UP MARKETS

6 September 2010, Financial Times

The bifurcated character of the market over the past year has compromised the profitability of many hedge fund strategies, especially those focused on stocks. While equity long, equity long/short, emerging markets, and various sector funds registered strong double-digit gains during the second half of 2009, nearly all lost money during the first half of 2010, according to hedge fund data tracker BarclayHedge.

“We saw faith in economic recovery continue unabated in the third and fourth quarter of last year,” observes Sol Waksman, founder of BarclayHedge, “but in the second quarter of 2010, sovereign debt fears combined with doubts about recovery sent investors selling.”

However, several hedge fund strategies thrived during both environments, including convertible and fixed income arbitrage, distressed securities, and event driven. And what these strategies have in common, says Mr Waksman, is that they do particularly well when interest rates are falling.

US Treasury yields, between the end of the second quarter 2009 and the end of the second quarter 2010, have fallen across the entire yield curve, from three months out to 30 years. Two-year rates were down 56 basis points, five-year rates fell 92 bps, and 10-year rates were off 78 bps. These modestly sounding adjustments were substantial in relation to where rates had been.

Given the delicate state of recovery, many market observers think policymakers would be reluctant to start ratcheting up rates. And intense borrower focus on risk aversion is preventing lenders from raising rates on the long end.

So at least for the balance of this year, which is likely to be characterised by starts and stops as the market tries to discern the uncertain shape of things to come, these strategies may offer the greatest promise.

Allan Weine, chief investment officer of the $670m (£436m, €529m) Castle Creek Arbitrage Fund, which focuses on convertible bond arbitrage, says falling interest rates and tightening credit spreads have helped his performance. He also cites improving liquidity, which is reducing bankruptcy and improving the overall sense of security. His fund was up over 12 per cent in the last half of 2009 and nearly 2 per cent in the first six months of 2010.

But Mr Weine feels the strategy has received a big boost from falling competitive demand. “The combination of hedge funds closing up shop and proprietary trading desks distancing themselves from these investments due to fear of regulatory response, has cut the number of participating institutional investors by one-third,” he says.

This has enabled spreads to remain attractive for a longer period, giving him more time to act.

Bob Treue’s $450m Barnegat fixed income arbitrage fund has benefited from similar factors. The Hoboken, New Jersey-based fund has made money over 11 of the past 12 months, having soared more than 27 per cent during the second half of last year and returning more than 9 per cent during the first half of 2010.

But Mr Treue’s eye for anomalies created by market behaviour driven by non-economic factors has also helped.

For example when the Bank of England started pumping money into the UK economy via quantitative easing in March 2009, it began buying five-to 25-year gilts on the secondary market, spending £200bn over the next 12 months. Because investors knew the Bank was willing to buy longer-dated maturities, this sent their prices higher and yields lower.

Mr Treue discovered four-year gilts yielding more than the five-year bonds simply because less market demand for them. This produced a kink in the sharply rising British yield curve and a compelling arbitrage opportunity.

He went long four-year gilts and shorted five-year gilts, believing that once the Bank suspended quantitative easing, four-year gilts would rise and five-year gilts would fall. And in the spring of 2010, when the bank announced it would pause pumping money into the economy, his prediction played out.

But his contrarian approach is predicated on keeping 40 to 50 per cent ofthere was his assets liquid. “I have a very high degree of confidence in my investments,” says Mr Treue, “but I can never be certain how long they will require to pan out.” Being able to afford temporary reversals enables him to weather setbacks that have forced other managers to sell.

The recent sell-off of equities and reversal of macro trends in the second quarter (such as the euro rallying and gold falling) has dampened first half returns at the $2bn Perella Weinberg Partners Xerion Fund, an event driven/distressed securities fund that is driven by flexible macrothematic strategy.

BarclayHedge reported that after the fund soared more than 24 per cent during the second half of last year, it added a more modest 1.4 per cent during the first six months of 2010. But this does not faze manager Daniel Arbess because he sidestepped the brunt of the second quarter’s volatility, and the macro issues that worried him coming into the year have subsided.

Unlike other specific strategy managers, Mr Arbess has profited from searching out value across the capital structure, using a full range of asset classes, including stocks, bonds, indices, derivatives, currencies and commodities.

In particular, he has enjoyed a significant boost from distressed securities, which have benefited from falling interest rates and improved credit conditions. This helped a number of troubled companies refinance and recover, which has pushed up the value of their debt.

Looking ahead, however, Mr Arbess expects to see market squalls that will keep investors nervous and prices volatile. Most uncertainty, he suspects, will come from the debate over whether policymakers should start tightening or continue stimulating the economy.

Tags: Argonaut, Balestra Capital, Barnegat Fund, Challenging Convention, Changing interest rate environment, Closed-end funds, Commodity Trading Advisors, Finisterre, Fundamental analysis, Global macro, Hedge funds, Infrastructure, Mergers and Acquisitions, mutual funds, Partners, Preferred stocks, Range-bound investing, Risk management, Strategies, Technical analysis, Trend following, Xerion Fund

This entry was posted on Monday, September 6th, 2010 at 6:47 pm and is filed under FUNDS, STRATEGIES. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.

Search

Opalesque Interview of Eric Uhlfelder