BUILD AMERICA BONDS ARE EASING THE MUNICIPAL BOND CRISIS

16 November 2010, Financial Times

US municipal bonds were traditionally thought of as among the most secure debt around, but a perfect storm hit the market last year, leading to a frozen municipal credit market.

The Obama administration responded with its Build America Bond (BAB) programme, which has enabled state and local governments, which mostly issue tax exempt bonds, to tap into the larger and more liquid taxable bond market. This was a dramatic move that has introduced new opportunities and risks to international investors.

The storm that fell on the muni market started with the collapse of creditworthiness of underlying muni bond insurers. These included MBIA, Ambac, and XL Capital Assurance, which were collectively insuring up to half of all outstanding municipal bonds several years ago. Geoffrey Schechter, manager of the MFS Municipal High Income Fund, surmises that no more than 10 per cent of all new issuances now carry meaningful bond insurance.

Over recent years, insurance provided a financial backstop that stimulated demand for municipals for carry trades. Various asset managers and funds were borrowing short, at low rates, and investing long in municipals that were guaranteeing payment that was several times higher.

However, downgrading of insurers forced massive deleveraging of these carry trades. The supply of municipals exceeded demand, driving down the prices of these securities. This sent their yields – normally about 85 to 90 percent of Treasuries because of their tax advantages – up NEVADA to three times those of $622m Treasury yields.

Meanwhile, economic recession continues to eat $8.28bn into government tax revenues while demand for services is rising with growing unemployment and the need for government spending to regenerate growth.

At the same time, the reliability of the same credit $70m rating agencies that assured investors of the soundness of mortgage-backed and subprime securities has come into question regarding extant municipal ratings.

Last month, a former chief compliance officer at Moody’s Investors Service testified in front of the Congressional Committee on Oversight and Government Reform that his former employer did virtually no follow-up “surveillance” of its municipal bond ratings after they were initially made, despite Moody’s claim to the contrary.

This suggests municipal ratings that were issued before the financial crisis struck are still attached to the securities as they trade in the secondary market.

Seeing the potentially disastrous effects of local, country, and state governments and authorities unable to adequately access credit spurred the Obama administration to respond and in March, it introduced the BAB programme.

Traditional municipal bond coupons are lower than comparably rated corporate debt.

They attract wealthy investors because they are considered safe. Because these investors are taxed at the top income bracket, they come out ahead since interest is exempt from local, state, and federal taxes. However, the size of the municipal bond market is relatively small at $2,700bn (£1,617bn, €1,795bn).

The investor base for taxable bonds is $24,700bn. So the BAB programme is enabling local and state governments to access this more liquid market. It is doing so by providing 35 per cent of interest payments to municipal issuers opting to borrow from this costlier market.

This subsidy more than makes up for the higher interest payments.

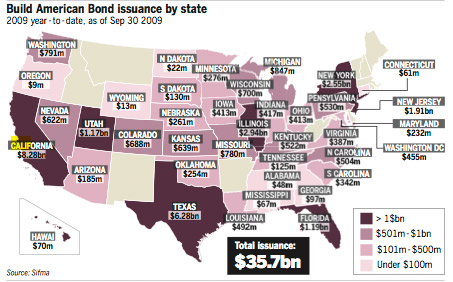

According to the Securities Industry and Financial Markets Association, a big industry clearinghouse, governments have issued nearly $36bn worth of BABs since the programme was launched at the end of September. In the third quarter alone, more BABs were issued than long-term municipals: $20.1bn versus $17.1bn. With the programme set to expire at the end of 2010, market observers expect total issuances to approach $100bn.

Bob Persons, who co-manages the $162m MFS Meridian Research Bond fund, has begun building a position in BABs. This spring his fund initially established a 1 per cent position in various taxable securities. Yields were above equivalently rated corporate bonds. “We dipped into the market,” says Mr Persons, “because when initially offered, these bonds offered attractive relative valuation and added diversity to our portfolio.” They have since appreciated about 20 per cent.

Foreign investors are responding to these taxable issues. According to the latest available Federal Reserve data, holdings of long-term municipal securities by “the rest of the world” rose $5.6bn, or 14 percent, to $45.6bn during the April-through-June period. Matt Fabian, managing director of Municipal Market Advisors, an independent research firm, believes this must involve BABs.

Several mutual fund companies are buying to repackage bonds to enhance access to BABs. Invesco PowerShares is planning an ETF comprised of these bonds. And Eaton Vance is developing an open-end mutual fund version.

Whatever the result of the BAB programme, the paucity of Treasury yields, or diminishing fear about municipals, the market for tax-exempt municipal bonds has improved. Second and third-quarter inflows into these securities soared to five times normal levels, exceeding more than $1bn a week, according to Konstantine Mallas, portfolio manager of T. Rowe Price’s Summit Municipal Income Fund. This has helped yields to draw about even with Treasuries. But that ratio still suggests concerns about the health of municipals and the market environment in general.

Investors need to be cautious. First, the federal government subsidy of BABs does not make such municipals any safer than their tax-exempt brethren. Financial due diligence remains challenging.

Richard Ravitch, the man who helped steer New York City out of its severe budget crisis in the mid-1970s and currently the Lieutenant Governor of New York State says he believes states “will face deficits the year after the stimulus ends of $300bn to $500bn a year”. He thinks we may begin to see cracks in the municipal bond market as early as next spring.

GIR's Investing in the New Europe

GIR's Investing in the New Europe